- Details

- By Elijah Moreno, Christian Dippel and Justin Siken, Special to Tribal Business News

- Native Contracting

Utilizing data from a mergers and acquisitions (M&A) database, provided by HigherGov, this analysis reveals a significant trend: the increased use of M&A by Alaska Native Corporations, Native Hawaiian Organizations and Federally Recognized Tribes within the federal contracting industry.

In 2023, a company owned by Alaska Natives and headquartered in a town with a population of less than 5,000 acquired a company for $350 million in cash, shaking up the mergers and acquisition (M&A) market in federal contracting. This move reflects a larger trend: Native entities, including Alaska Native Corporations (ANCs), Native Hawaiian Organizations (NHOs) and federally recognized American Indian and Alaska Native tribes, are strategically expanding their federal contracting presence through M&A.

Over the past 23 years, Native entities acquired companies that generated nearly $10 billion in federal contracting revenue prior to their acquisition. Furthermore, in 2023, M&A deals involving Native entities comprised over 4.1% of the total within the federal contracting sector. Through novel data, this analysis offers new insights into Native entities growing use of M&A in federal contracting.

Mergers and acquisitions are when one company acquires another, partially or wholly, to consolidate or operate as a subsidiary. This strategic approach helps Native entities compete in the federal contracting market more effectively and diversify their business offerings. We draw on HigherGov's extensive Aerospace, Defense and Government (ADG)-focused M&A database, supplemented by research by the authors and Tribal Business News into the top 50 Native entities and their subsidiaries for this analysis.

Want more Native contracting news? Get it here from TBN.

We examined mergers and acquisitions among Native entities from 2000 to 2023, specifically focusing on transactions where Native entities gained controlling stakes in firms. Our analysis focuses on data from 2000 to 2023 because earlier federal contracting data are less reliable.

We've identified 100 companies acquired by 47 unique parent Native entities during this period. While a subsidiary such as Akima LLC can purchase a company, we aggregate the data by its parent Native entity. In this example, the parent Native entity is NANA Regional Corporation which is an ANC. We also examined the characteristics of companies acquired by Native entities. We found a noticeable rise in mergers and acquisitions among Native entities, particularly in the professional and business services sector.

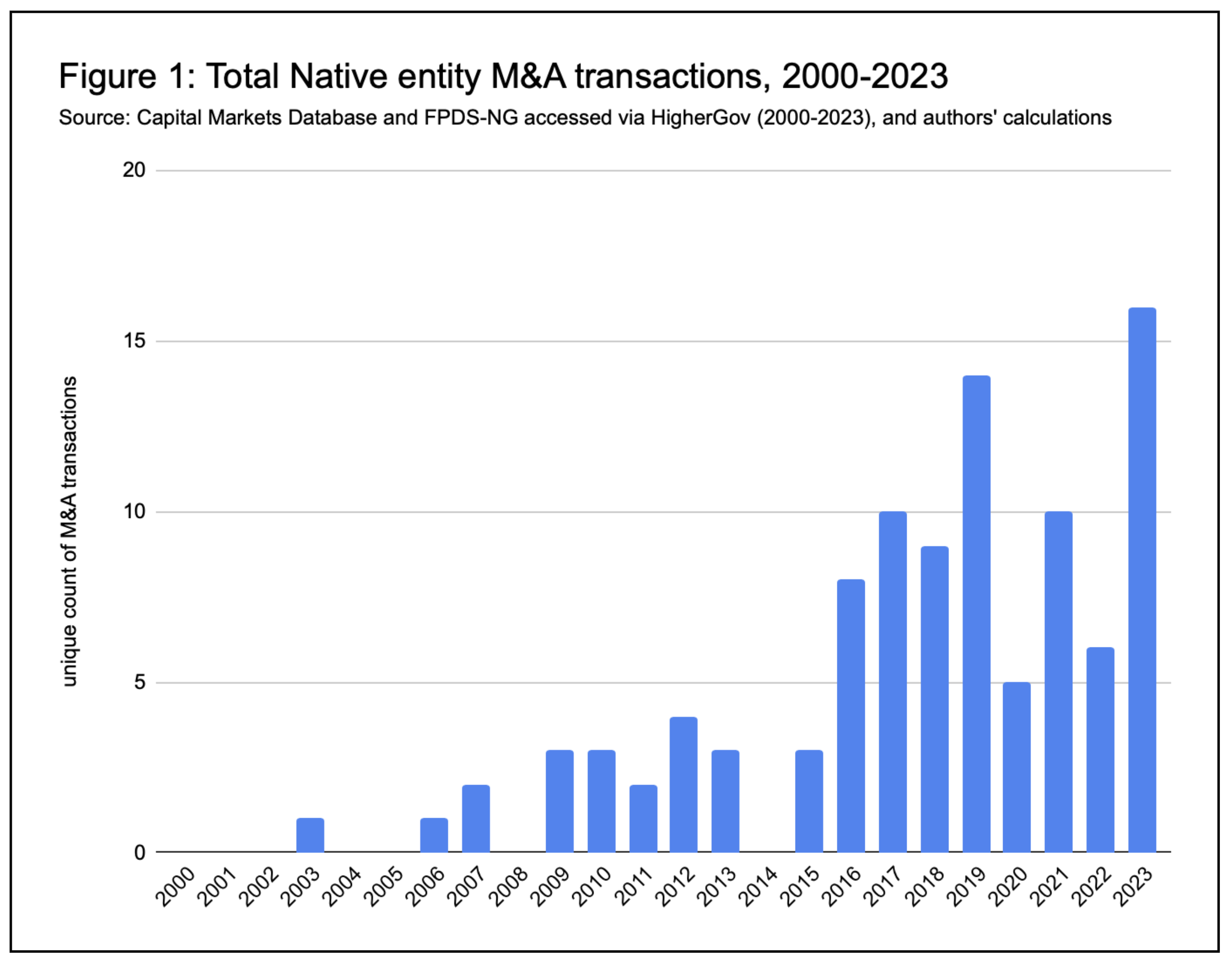

Our analysis, depicted in Figure 1, reveals a steady stream of M&A activity among Native entities in the early 2010s, escalating notably in recent years, with 2023 marking the largest single year of M&A activity. From 2000 to 2023, we observed a 12.8% annualized growth rate in M&A transactions among Native entities. This surge reflects increased opportunities and investment from Native entities within the federal procurement industry. Additionally, our findings indicate that 32.9% of acquired companies were certified with the Small Business Administration (SBA) under the 8(a) program before their acquisition. Notably, only a small fraction of acquired companies without 8(a) status before acquisition obtained 8(a) status post-acquisition from their new Native entity owners.

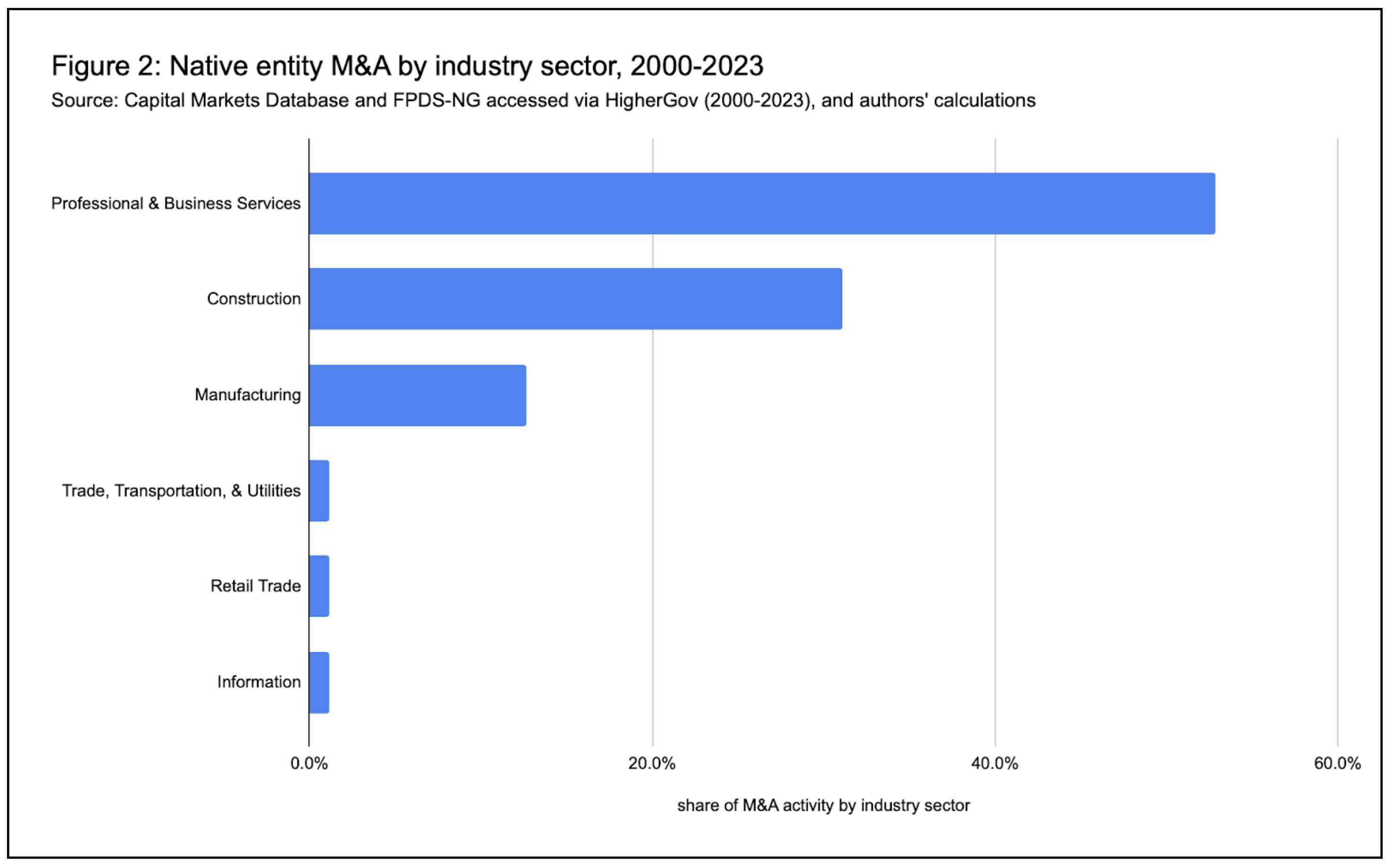

The sectors targeted by Native entities align closely with their primary revenue sources, with professional and business services, construction, and manufacturing dominating M&A activity as Figure 2 shows. In terms of contracts these firms obtained before their acquisition, 68.6% had secured Department of Defense (DoD) contracts. Alaska Native Corporations lead these investments, comprising over 51% of M&A activity, followed closely by tribes at 42.5% and then Native Hawaiian Organizations with 6.5%.

For tribes who pursued M&A in federal contracting, 90% have casino gaming operations. While some Native entities acquire companies when they are new or emerging participants in the federal contracting space, most M&A activity is driven by more established players. This implies that growth among established Native entities may require significant capital investment.

This baseline analysis provides the first look at mergers and acquisitions activity among Native entities in federal contracting. While there may be some M&A activity among Native entities we are unable to capture—for example, M&A activity that occurred before 2000—this analysis nevertheless gives a lower bound estimate to M&A activity among ANCs, NHOs and tribes that compete in the federal contracting sector.

To our knowledge, this is also the first analysis that examines M&A activity among verified Native American businesses in general. Native entities are increasingly turning to mergers and acquisitions in government contracting as a way to grow and stay competitive in the field. Through this growth, Native entities can increase their revenue so that they can better support their respective Native communities throughout the United States.

ABOUT THE AUTHORS

Elijah Moreno is a researcher and graduate student studying Indigenous economic development.

Christian Dippel is the Donald F. Hunter Professor in International Business at Ivey Business School in Ontario, Canada. He is a Research Associate at the National Bureau of Economic Research, a founding co-editor of the Journal of Historical Political Economy, a consultant with the Federal Reserve Bank of Chicago, and a Campbell Fellow at Stanford’s Hoover Institution. His research has been funded by the National Science Foundation and has been published in Econometrica and the American Economic Review, among other outlets. Christian is an expert on non-market strategy, governance, and Indigenous economic development.

Justin Siken is the Founder of HigherGov, a market intelligence platform that helps federal, state and local government contractors, grant recipients, agencies, and advisors find and seize opportunities and better serve the American public. Before founding HigherGov, he was an M&A advisor who advised on more than 25 transactions worth over $10 billion in the Government and FinTech markets.