Finance

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

The Soboba Band of Luiseño Indians closed a $219 million senior secured credit package to refinance existing debt and fund construction of an on-site energy facility at its Riverside County gaming resort, according to the lead arranger.

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Free

- Reader Survey Question: No Question

There was a time not long ago when capital simply did not move in Indian Country.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Free

- Reader Survey Question: No Question

Talking with Robert J. Miller is a reminder of how much of American economic history has been misremembered — or deliberately forgotten.

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Tribal governments face higher costs than state and local governments when issuing bonds in public markets, according to new research from the Center for Indian Country Development at the Federal Reserve Bank of Minneapolis — a structural gap that can shape how tribes finance infrastructure and enterprise development projects.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Tallsalt Advisors has formed a majority Native-owned joint venture with Derivative Logic to provide independent interest rate hedging advisory services for tribal governments, tribal enterprises, nonprofits and institutions, the firms announced.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Difference Makers 3.0, a podcast partnership between Tribal Business News and the Native CDFI Network, will launch its new season Thursday, Feb. 12, expanding the series’ focus from small business lending into a broader examination of Native finance, policy, and impact.

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

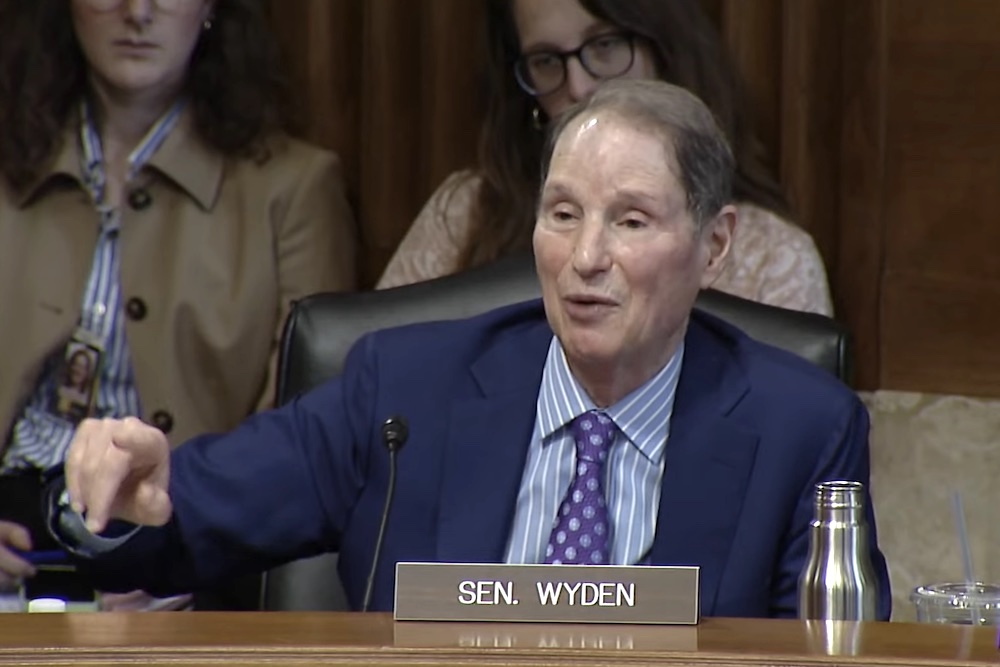

Senate Finance Committee ranking member Ron Wyden (D-Ore.) urged the Securities and Exchange Commission to consider delisting White River Energy Corp., accusing the company of repeatedly violating federal securities laws while concealing a federal criminal investigation tied to the sale of nonexistent “tribal tax credits.”

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Jamul Indian Village Development Corporation has refinanced $425 million of senior secured debt tied to the Jamul Indian Village’s gaming and resort operations in San Diego County, according to transaction details released by the lead arranger.

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Turning Stone Resort Casino, LLC, a governmental instrumentality of the Oneida Indian Nation, has closed a $440 million senior secured revolving credit facility that will refinance existing debt and provide flexible capital to support a $370 million expansion of its flagship resort in Central New York.

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

The Community Development Financial Institutions Fund on Dec. 23 awarded $10 billion in New Markets Tax Credits to 142 organizations for 2024-2025, including nine organizations that committed to investing in Native areas.