Finance

- Details

- By Megan O’Matz and Joel Jacobs, ProPublica

- Finance

- Type: Default

- Paywall Status: Free

- Reader Survey Question: No Question

The sprawling business empire created by tribal leaders in northern Wisconsin was born of desperate times, as the Lac du Flambeau Band of Lake Superior Chippewa Indians faced financial ruin. Its subsequent success would be built on the desperate needs of others far from the reservation.

- Details

- By Megan O’Matz and Joel Jacobs, ProPublica

- Finance

- Type: Default

- Paywall Status: Free

- Reader Survey Question: No Question

In bankruptcy filings and consumer complaints, thousands of people across the country make pleas for relief from high-interest loans with punishing annual rates that often exceed 600%.

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

More than $80 million in U.S. Treasury funding could catalyze an additional $830 million in economic opportunities for Alaska Native small businesses, officials said during a press call Tuesday.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

The U.S. Department of the Treasury announced $65 million in funding to support Native American small business and entrepreneurship through the State Small Business Credit Initiative (SSBCI).

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

The nonprofit Native CDFI Network and banking giant Wells Fargo on Thursday announced a year-long initiative to bolster economic opportunities and financial inclusion for Native American communities in California and Nevada.

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

In early 2023, the Federal Home Loan Bank of Topeka (FHLB Topeka) wondered if they would see demand for a new grant program for Native American housing projects.

- Details

- By Chez Oxendine

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

A new grant fund could help close the funding gap for Native homeowners in several southwestern states.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

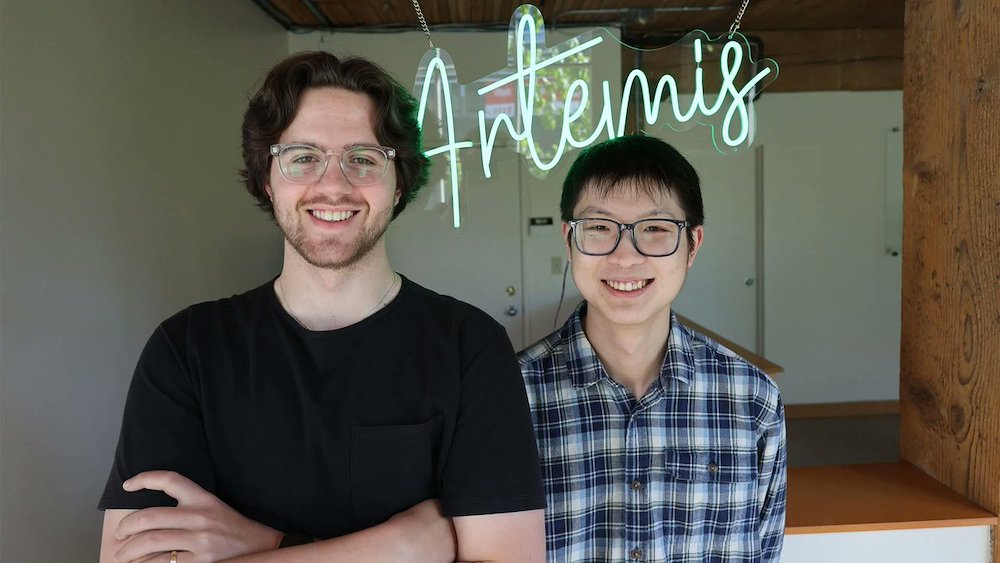

Artemis, a Vancouver-based technology company led by Indigenous co-founder Josh Gray, has secured $1.5 million in pre-seed funding to simplify data preparation and automate data cleaning for businesses.

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

In a move hailed as a "significant step forward,” U.S. Reps. Gwen Moore (D-WI) and David Schweikert (R-AZ) introduced the bipartisan Tribal Tax and Investment Reform Act on Wednesday.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Free

- Reader Survey Question: No Question

This week, the Native CDFI Network and Tribal Business News are launching a yearlong podcast series highlighting how Native community development financial institutions (CDFIs) work alongside their small business clients to accelerate change and create economic opportunities in Native communities.