Finance

- Details

- By Joe Boomgaard

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

The Native CDFI Network wants to engage with the U.S. Department of the Treasury to discuss how the agency plans to deploy a potentially “transformational” $1.75 billion fund targeted at minority lending institutions.

- Details

- By Mark Fogarty

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

I can remember the exact instant I became aware that lenders did not make mortgages on American Indian reservations.

It was at a 1994 community development meeting in Honolulu co-hosted by the Federal Reserve and the Federal Home Loan Bank of Seattle. Deval Patrick, later governor of Massachusetts but then the U.S. Assistant Attorney General for civil rights, addressed the meeting and then opened the floor for questions. The first one came at him fast and hard.

- Details

- By Erin Tapahe

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

ATLANTA, Ga. — In launching the Peachtree Minority Venture Fund, students at Emory University want to address the wide disparity in the amount of venture capital invested in traditionally underrepresented minority groups.

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

When Cherilyn and Mike Yazzie started Dilkon, Ariz.-based Coffee Pot Farms in 2018, they used their own savings rather than rely on lenders for the upfront costs of starting the agricultural business.

- Details

- By Rob Capriccioso

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

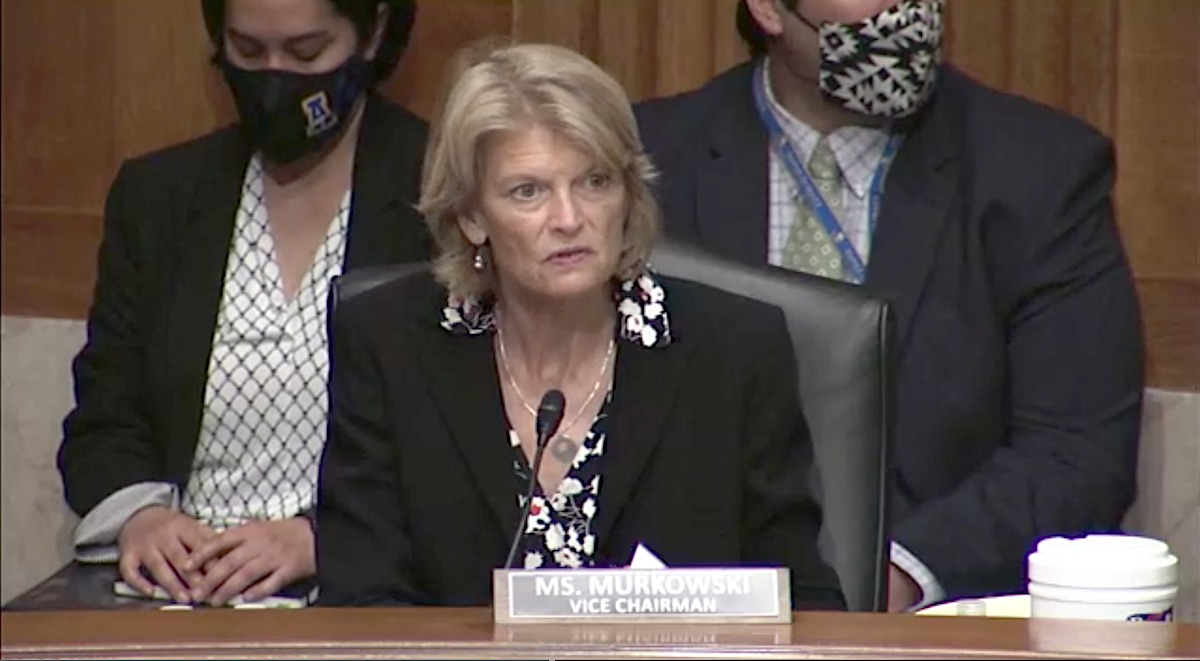

WASHINGTON — Alaska Republican Sen. Lisa Murkowski is reiterating her call for the creation of an Office of Tribal Affairs in the U.S. Department of the Treasury.

- Details

- By Joe Boomgaard

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

PENDLETON, Ore. — Dave Tovey never quite grasped an economic lesson from one of his longtime mentors until recently in his career when he began to head up a Native community development financial institution for his tribe.

House infrastructure proposal aims for tribal tax-exempt borrowing parity with states and localities

- Details

- By Rob Capriccioso

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

WASHINGTON — The U.S. House Ways and Means Committee is in the process of deciding whether to include less restrictive tax-exempt financing opportunities for Indian Country in the $3.5 trillion infrastructure budget reconciliation now under consideration in Congress.

- Details

- By Rob Capriccioso

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

A group of Indigenous-focused policy and legal advocates is taking steps to ensure that the U.S. Securities and Exchange Commission is responsive to tribal human and land rights whenever the agency makes disclosures to investors.

- Details

- By Mark Fogarty

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Indian Country seems like a slam dunk for the New Markets Tax Credit, a program implemented by the Treasury Department to boost investment in economic development and infrastructure in distressed and underserved communities. But just one Native-led organization received an award for an allocation of these tax credits this year, and the sector got nothing for the three years before that.

- Details

- By Joe Boomgaard

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

For the first time in the six-year history of the Wisconsin Indian Business Alliance, the coalition of four Native community development financial institutions will have a new chair.