Finance

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

VIAN, Okla. — Strategic financial consulting firm Native Advisory LLC has earned certification as a B Corporation, a move that could open an array of new business opportunities for the company.

- Details

- By Tribal Business News Staff

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

OKLAHOMA CITY, Okla. — CPA and advisory firm REDW LLC has appointed Kevin Huddleston as its new director of gaming operations.

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

WASHINGTON — Not long after Interim CEO Pete Upton (Ponca) welcomed attendees to the Native CDFI Network’s Annual Policy & Capacity Building Summit in Washington DC earlier this month, he announced a last-minute change to the day’s agenda.

- Details

- By Joe Boomgaard

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

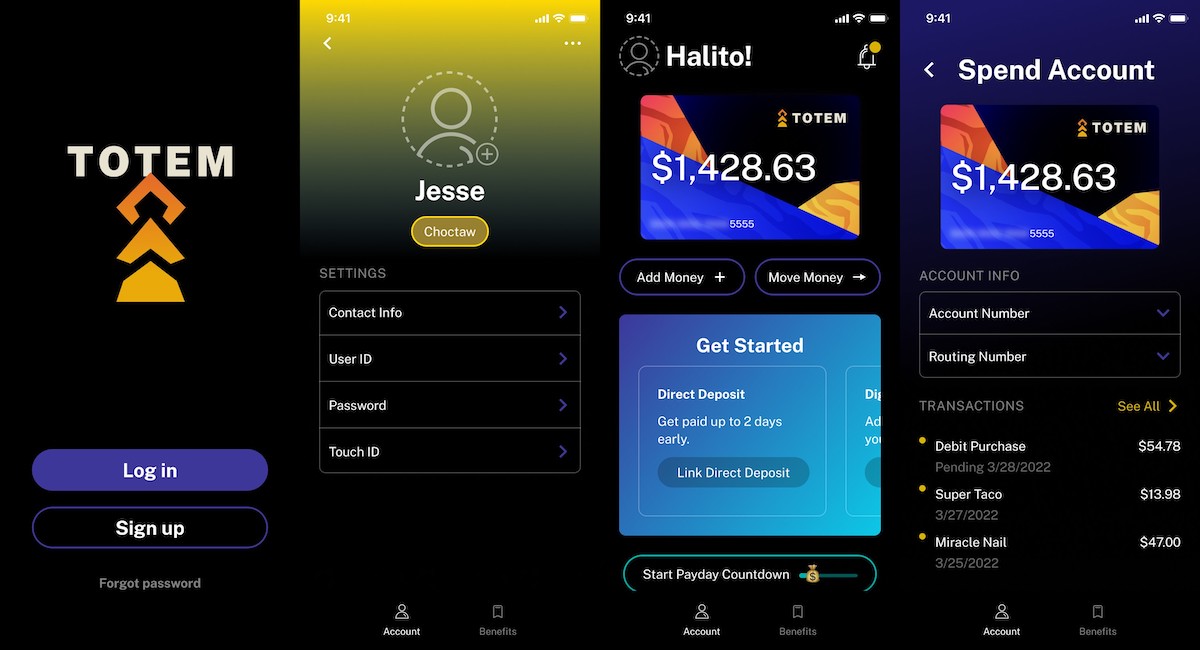

TULSA, Okla — Native-founded and -led fintech startup Totem Technologies Inc. plans to use the proceeds from its $2.2 million pre-seed round to continue developing its technology and building out its staff.

- Details

- By Elyse Wild

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

Newly proposed changes to a U.S. Department of the Treasury fund that has been critical to driving Native economic development and access to capital could have devastating effects in Indian Country.

- Details

- By Tribal Business News Staff

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

MASHANTUCKET, Conn. — Mashantucket Pequot Tribal Nation Chief Financial Officer Jean Swift has been appointed to the U.S. Department of the Treasury Tribal Advisory Committee (TTAC).

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

WASHINGTON — An annual award that recognizes Native financial institutions for providing access to fair, affordable funding in Indian Country has named its three honorees for 2022.

- Details

- By Chez Oxendine

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

Private investment in Native businesses and tribal economies largely centers on one resource: data.

- Details

- By Tribal Business News Staff

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

Native CDFI Network has partnered with one of North America’s largest banks to launch an initiative aimed at driving economic growth in Native American communities.

- Details

- By Mark Fogarty

- Finance

- Type: Default

- Paywall Status: Protected

- Video Link: https://youtu.be/orQCArStQek

- Reader Survey Question: No Question

Having a Native community development financial institution in a Native community correlates to improved credit scores for residents by a hefty 45 points.

That’s according to Libby Starling, director of community development at the Minneapolis Federal Reserve Bank, who cited research by the Center for Indian Country Development that showed a 45 point average gain in Equifax credit scores in Native communities if there was an average ratio of one Native CDFI staff member to 1,000 residents.