Finance

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

The Chickasaw Nation announced the establishment of Pennington Creek Capital, a private capital investment firm set to open an office in Dallas, Texas.

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

LAS VEGAS — The United States Treasury announced a new round of approvals for tribal support under the State Small Business Credit Initiative (SSBCI), a 2010 program aimed at helping open new avenues to credit by supporting funding institutions.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

A settlement between the state of Colorado and Kansas-based debt collector TrueAccord will refund $500,000 to borrowers who defaulted on loans issued by tribal lending entities.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

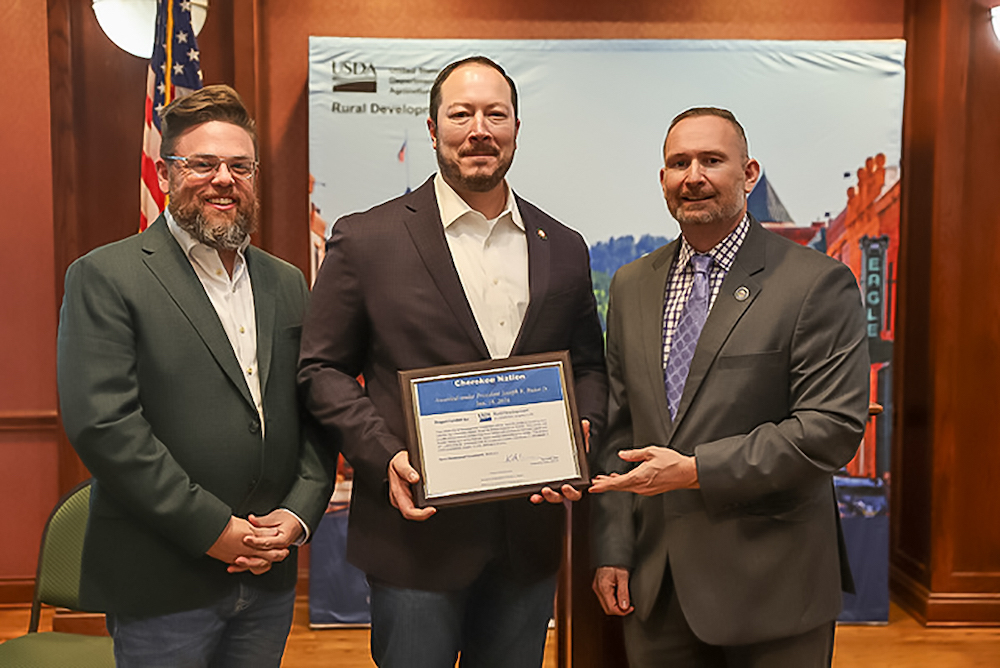

The Cherokee Nation said it received a $500,000 grant from the Department of Agriculture’s Rural Development agency in support of Cherokee citizen-owned small businesses.

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

The Navajo Nation said it received notice Friday that it was awarded $88.7 million through the Treasury's State Small Business Credit Initiative (SSBCI) program.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Free

- Reader Survey Question: Business Topics

Here are 11 of our most-read Tribal Business News stories this year about access to capital in Indian Country.

- Details

- By Chez Oxendine

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: Business Topics

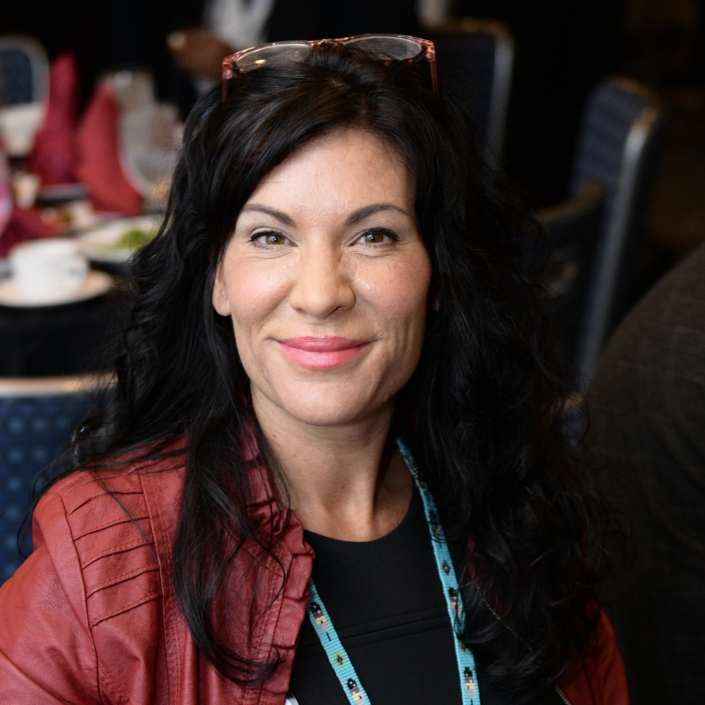

New changes introduced by the Treasury’s Community Development Financial Institution (CDFI) Fund could “pose several challenges” for Native CDFIs, says Oweesta Corporation’s CEO Chrystel Cornelius. But there is also some upside, she adds.

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

Native Community Development Financial Institutions (CDFIs) are breathing a sigh of relief after the Treasury released long-awaited final revisions to the CDFI certification application late last week.

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

Officials from the United States Treasury plan to announce more than $86 million in State Small Business Credit Initiative (SSBCI) funding for two dozen tribal governments during the White House Tribal Nations Summit today.

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

Revised regulations to a law meant to assess and support banks in meeting the credit needs of the communities they serve could increase support for Native businesses, communities, and individuals.