Finance

- Details

- By Joe Boomgaard

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

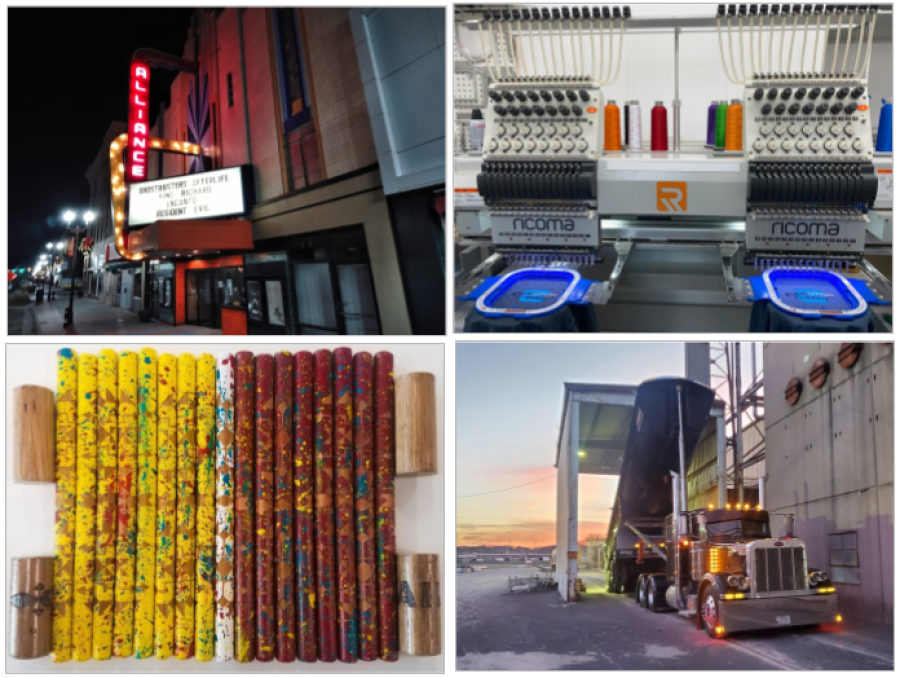

HERMON, Maine — When it came time for civil engineer Troy Devoe to expand his screen printing hobby into a full-time business, he turned to a familiar financial adviser for help.

- Details

- By Joe Boomgaard

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Patrice Kunesh has a unique perspective on the effects that Native community financial development institutions have across Indian Country.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Free

- Reader Survey Question: No Question

With this multimedia reporting project, Tribal Business News is examining the crucial role Native Community Development Financial Institutions (CDFIs) play in supporting small business formation and growth in Native American communities.

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

ALLIANCE, Neb. — Serial entrepreneur Edison Red Nest III elevated his family’s passion for movie nights to the next level.

- Details

- By Joe Boomgaard

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

MILWAUKEE, Wis. — After a year out of work due to a bad injury in 2005, Norman Kitchenakow lost his independent trucking business, his house and all the good credit he’d built up to that point in his life.

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

The U.S. Department of the Treasury has again extended the deadline for applications for its State Small Business Credit Initiative that could create $500 million in credit opportunities for Native-owned small businesses.

- Details

- By Joe Boomgaard

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Given the lack of access to capital in Indian Country, Indigenous entrepreneurs have fewer places to turn for help when it comes time to start or grow their businesses.

In a growing number of communities across the country, Native Community Development Financial Institutions (CDFIs) are stepping up to fill part of that void.

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

RAPID CITY, S.D. — Walt Swan Jr. says his “ugly mug” adorns the front of the South Dakota Economic Impact Report from Google because of advice he received from the Four Bands Community Fund.

- Details

- By Joe Boomgaard

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

MINNEAPOLIS, Minn. — A venture capital firm founded to invest in Black, Latinx and Indigenous technology startups has partnered with three tribes to create equity financing solutions that fit with tribal values.

- Details

- By Mark Fogarty

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

A Utah tribe that owns a mortgage banking agency is promoting down payment assistance as a way of boosting the volume of home loans among American Indians and all minorities.