- Details

- By Tribal Business News Staff

- Finance

With this multimedia reporting project, Tribal Business News is examining the crucial role Native Community Development Financial Institutions (CDFIs) play in supporting small business formation and growth in Native American communities.

This special report features conversations with Native CDFI executives, profiles of Native businesses and an online interview with an expert on Native American economies. In support of this special reporting package, Tribal Business News received a grant from URL Media, a national network of BIPOC media outlets, and the Knight Lenfest Local Media News Transformation Fund.

You can read the stories via the links below or download a PDF of the entire series.

Executive roundtable:

Expert interview:

Kunesh weighs in on Native CDFIs’ role in helping Native entrepreneurs access capital

Native business profiles:

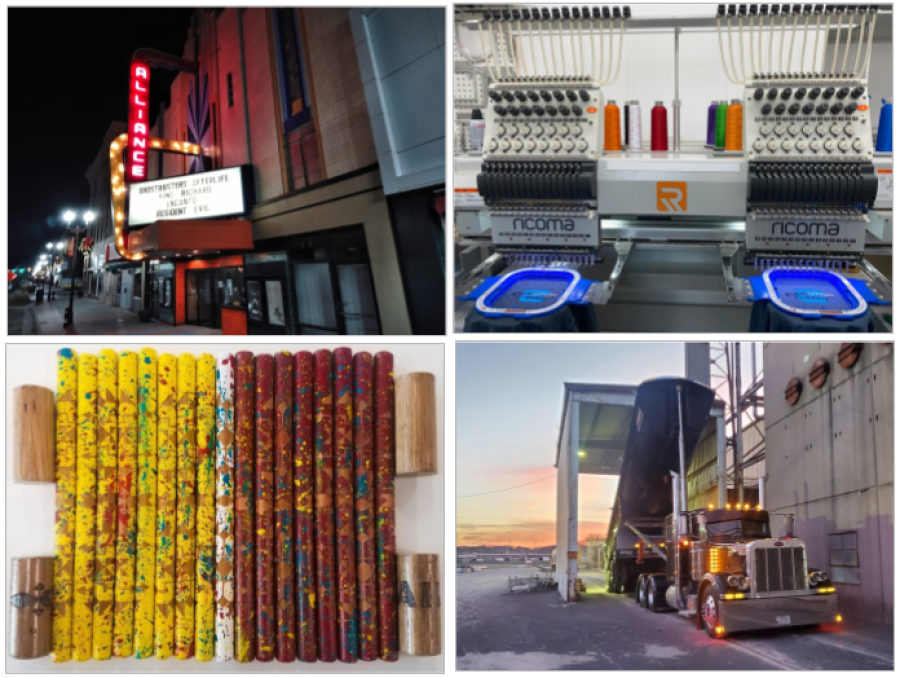

Entrepreneur taps into Native CDFI to scale up from a hobby to full-time business

Native CDFIs partner to help Oglala Sioux serial entrepreneur acquire Nebraska theater

Native trucking company credits First American Community Capital for rebirth, expansion

HeSapa Enterprises founder credits Native CDFI for early successes, expansion

Related stories:

Proposed Community Reinvestment Act rules provide new visibility to Indian Country

Resources:

Native CDFI Network: Find a Native CDFI

U.S. Department of the Treasury’s CDFI Fund: Native Initiatives

Federal Reserve Bank of Minneapolis, Center for Indian Country Development: Native CDFIs improve credit outcomes for Indian Country residents