- Details

- By Brian Edwards

- Finance

The U.S. Department of Treasury has finished approving more than $500 million in State Small Business Credit Initiative (SSBCI) funding for federally recognized tribes, marking the final round of a program aimed at boosting Native American entrepreneurship and small businesses.

U.S. Deputy Secretary of the Treasury Wally Adeyemo announced this morning that the half-billion dollars in SSBCI funding is expected to leverage up to $5 billion in additional financing for Native enterprises and small businesses. "The truth is that by investing in tribal small businesses and the ecosystem that supports them, we are investing in the self-determination of those people who live in Indian Country," Adeyemo said during a press call.

This fifth and final round of funding completes the $500 million in funding set aside for tribes under the SSBCI program, part of a larger $10 billion initiative from the American Rescue Plan Act. The round announced today includes up to $86.9 million for the Cherokee Nation and $15 million across eight other tribal applications, plus $3.9 million in Technical Assistance (TA) grants to 14 tribal governments. The combined capital and TA funding brings the total SSBCI allocation for tribes to $523 million, reaching 235 Tribal Nations.

During the press call, Cherokee Nation Principal Chief Chuck Hoskin Jr. praised the SSBCI program as a "bold initiative" that could be a game-changer for economic development in Indian Country. The Cherokee Nation plans to offer loans of up to $5 million, with the first loan expected to be issued within 75 days, he said.

"Historically, the challenge has been private sector job development in Indian Country, and meeting that challenge has not historically been met with sufficient capital, not sufficient access to loans," Hoskin said. "This, I think, is a game changer in that regard."

Chickasaw Nation Governor Bill Anoatubby highlighted his tribe's plans to use the SSBCI funding to implement a technical assistance program for Chickasaw citizen-owned businesses and other small, underserved businesses where Chickasaw citizens reside. The program will provide legal, accounting, and financial services, as well as connect businesses to other funding opportunities, he said during the press call.

Anoatubby also outlined the tribe's focus on two primary economic development clusters: agriculture and residential and commercial construction. In agriculture, the funding will assist businesses entering or expanding operations in pecan farming and other specialty crops within the Chickasaw Nation treaty territory. The construction focus will target Ardmore, Okla., a city facing economic transition due to a major plant closure. The program could also significantly impact the Ardmore area by helping restore lost jobs in that community, Anoatubby said.

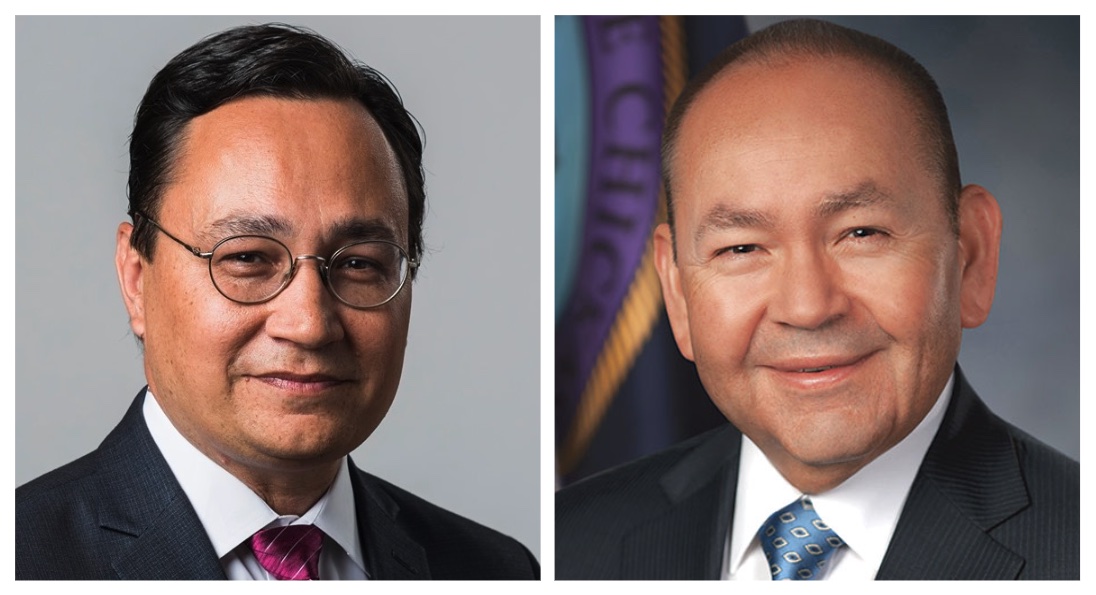

Cherokee Nation Principal Chief Chuck Hoskin Jr. (left) and Chickasaw Nation Governor Bill Anoatubby (right) outlined plans for using SSBCI funding to boost small businesses in their communities. Their tribes received significant allocations in the Treasury's $523 million program for Indian Country.In addition to the SSBCI funding, both tribal leaders highlighted complementary $2 million awards their tribes received through the Treasury's Small Business Opportunity Program (SBOP). Chief Hoskin noted that Cherokee Nation Commerce Services will use this grant to connect underserved small businesses across their 14-county territory with industry experts and local financial institutions, aiming to create quality jobs and improve rural healthcare.

Cherokee Nation Principal Chief Chuck Hoskin Jr. (left) and Chickasaw Nation Governor Bill Anoatubby (right) outlined plans for using SSBCI funding to boost small businesses in their communities. Their tribes received significant allocations in the Treasury's $523 million program for Indian Country.In addition to the SSBCI funding, both tribal leaders highlighted complementary $2 million awards their tribes received through the Treasury's Small Business Opportunity Program (SBOP). Chief Hoskin noted that Cherokee Nation Commerce Services will use this grant to connect underserved small businesses across their 14-county territory with industry experts and local financial institutions, aiming to create quality jobs and improve rural healthcare.

Governor Anoatubby explained that the Chickasaw Nation will focus its SBOP award on supporting businesses in its 13-county treaty territory and Chickasaw-owned businesses nationwide, particularly in agriculture and construction. The Chickasaw initiative will be bolstered by an additional $225,000 in matching funds from the tribe's own community development entity.

These SBOP grants, working in tandem with the SSBCI funds, underscore the multi-faceted approach the Treasury is taking to bolster economic development in Indian Country, according to a Treasury statement.

The SSBCI funding is structured to have a multiplier effect on small-business development and growth in Native communities. Every $1 of SSBCI capital funding is expected to "catalyze" up to $10 of private investment, amplifying the effects of the funding and providing small businesses with resources for growth, according to U.S Treasurer and lifetime Mohegan Chief Lynn Malerba.

"Small businesses, whether tribally owned or individually owned, are critical to creating jobs and growing tribal economies," Malerba told Tribal Business News in December 2023. "Tribal businesses also lift up the local economy by purchasing goods and services from other local businesses and by providing employment for local residents in addition to tribal citizens. We expect to see hundreds of tribal and Native small businesses expand through these awards."

In the Treasury statement today, Vice President Kamala Harris emphasized the SSBCI’s broader economic implications: "With this funding, these entrepreneurs will be able to access the technical assistance they need in order to hire more employees, grow their businesses, and advance innovation, which – in turn – grows our economy as a whole."

U.S. Congresswoman Sharice Davids (D-Kan.), co-chair of the Congressional Native American Caucus and an enrolled member of Ho-Chunk Nation, highlighted the program's potential long-term impact for Indian Country.

"Small businesses are the heartbeat of our economy, and Tribal businesses are vital employers on reservations and in their surrounding communities. Providing easier access to capital through resources like the SSBCI Program will empower Native entrepreneurs for generations to come," Davids, a former tribal economic development executive, said in a statement.

According to a Treasury official speaking on background, while this announcement represents most of the tribal allocations, it does not account for a small number of tribal governments whose applications are still under review.

Another Treasury official explained that the total approved funding actually exceeds the initial $500 million allocation, reaching $523 million, due to the Treasury adding incentive funds. More technical assistance approvals are expected in the future, as tribes complete the two-step approval process of securing capital allocations before becoming eligible for technical assistance funding.