- Details

- By Tribal Business Content Studio

- Sponsored Content

Native American communities in California and Nevada are facing a critical shortage of financial resources. Despite a combined Native American population of nearly 800,000 and 130 federally recognized tribes, these two states are home to only one certified Native community development financial institution (CDFI).

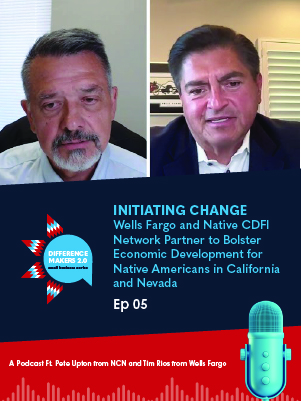

But change is on the horizon. The Native CDFI Network (NCN) and Wells Fargo have launched a groundbreaking year-long initiative to address this disparity. NCN CEO Pete Upton and Wells Fargo Senior Vice President Tim Rios visited the Difference Makers 2.0 podcast recently to talk about the initiative.

There are 64 certified Native CDFIs driving economic development in the Native American communities they serve, providing crucial access to capital through small business, home, vehicle and credit building loans, financial literacy, and technical assistance.

Native CDFIs fill critical gaps sown from centuries of systemic apathy for Native communities that have been otherwise excluded from mainstream banking, Upton told the Difference Makers 2.0 podcast. He emphasized the disparities that flourish in Native communities without access to financial institutions.

“Native American communities are at the top of the list for banking deserts, which means they don’t have financial resources to create wealth and jobs and better infrastructure,” Upton said during the podcast.

“Native American communities are at the top of the list for banking deserts, which means they don’t have financial resources to create wealth and jobs and better infrastructure,” Upton said during the podcast.

Upton describes the “brain drain” many of these communities experience — dire economic circumstances that force tribal members off the reservation and away from their communities to access economic opportunity.

“There are health and social impacts from not having financial resources. It comes with adverse health and social outcomes, higher poverty rates, substance abuse, and mental health issues,” Upton said.

Rios, the rural strategy leader and Invest Native lead for Wells Fargo, is a California resident. He underscored that the idyllic image many people have of the state contradicts the reality.

“I call California the ‘Tale of Two Cities,’” Rios said. “We have coastal California, which is fantastic, and probably the California that most people recognize. Inland California, it's a different place. It's also the place where there are more than 100 federally recognized tribes, and many of them are in inland California. At Wells Fargo, we recognize that there are more than 80 CDFIs in the state not representing or led by Native people, and probably not serving Native people.That was shocking to us.”

The initiative will involve a robust needs assessment to determine what resources are needed to spur on Native CDFI development and growth.

Upton said Wells Fargo — which has been working in Native communities for 65 years and has 80 branches on reservations across Indian Country — is an ideal partner for the initiative. The bank will support NCN’s efforts with its established networks and connections.

“We want to set NCN up for success,” Rios said. “We already do business with a lot of Native communities and Native families. So this is a logical step for us, in these two states with a combined hundreds of thousands of Native peoples.”

Native community advocates and leaders will also be critical to the initiative.

“What we want to do with this initiative is meet communities and the Native leaders where they're at and bring them along with us,” Upton said. “What it really comes down to is awareness and advocacy. We can't assume that everybody knows what a Native CDFI is, including tribes, and we have to do a better job at advocating.”

Native CDFIs are often not entities of tribal governments, but rather nonprofit entities formed by community leaders and advocates that incorporate under the state, the tribe, or sometimes both. An understanding of economic need and respect for cultural practices are essential for Native CDFIs to successfully serve their communities. Philanthropy foundations and established financial institutions are also key.

“It’s not always the tribal government that's going to take the lead on it, but none of this work can be done without the support of philanthropic foundations and also existing financial institutions,” Upton said.

The initiative aims to train 20 community leaders, provide capacity support to at least five Native communities, facilitate financial literacy and coaching to at least 100 individuals, and create a pool of up to $5 million for emerging Native CDFIs in California and Nevada.

While the current initiative is one year long, Upton said it’s just the beginning.

“I want to be able to be that resource that they can count on long after we leave. And we're not going to leave. We're going to remain there,” Upton said. “We're going to designate staff, we're going to designate consultants to really nurture that area. This is just the first year kick-off.”

Difference Makers 2.0 is a new yearlong series that highlights how Native community development financial institutions (CDFIs) work alongside their small business clients to accelerate change and create economic opportunities in Native communities. Join the Native CDFI Network and Tribal Business News as they shine a spotlight on the people accelerating economic change in Indian Country. Read the stories here and be sure to tune into the Difference Makers 2.0 podcast.