- Details

- By Tribal Business Content Studio

- Sponsored Content

“If you are not at the table, you are on the menu.”

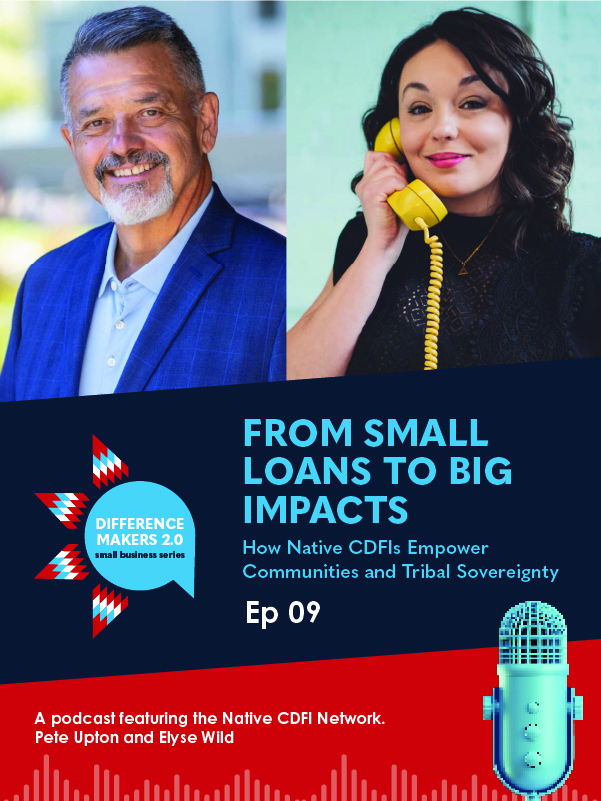

That sentiment guides Native CDFI Network CEO Pete Upton as he works to support Native community development financial institutions (CDFIs), advocating for policy and funding to elevate economic development across Indian Country. Upton always works to make sure Native CDFIs have a seat at the table when decisions are being made that affect Native communities.

As we approach the halfway mark of the Difference Makers 2.0 series, Upton sat down with podcast host Elyse Wild to discuss how Native CDFIs are helping small businesses and creating opportunities for Native communities. They also share some of their favorite stories from the podcast episodes so far and how NCN champions Indian Country’s voice, ensuring Native communities always have a seat at the table.

On how Native CDFIs have evolved:

PETE: We’ve made so much progress over the last five years. Native CDFIs have a seat at the table when it comes to philanthropy, and when it comes to governmental organizations —we have a voice at the table. We live by, “If you’re not at the table, you’re on the menu,” meaning that if you’re not actively involved in the conversations going on regarding appropriations or philanthropy, giving or strategies, we will be overlooked. I really pride myself in getting to the table as much as possible when it comes to philanthropy, visiting with congressional leaders, and serving on panels nationally.

On seeing Native CDFIs build tribal economies:

On seeing Native CDFIs build tribal economies:

PETE: I see it on a daily basis. We are in the state of Nebraska. We financed a native female-owned concrete company. When we first started working with them, they were doing maybe less than half a million dollars a year. Over the course of the last five to six years, that particular company has skyrocketed to where they have federal contracts in excess of eight to ten million annually.

It’s not always the dollar volume we’re looking at. It’s those small loans sometimes that we will make to a Native artist — maybe a $500 or a $5,000 loan — that really impact a family by allowing them to provide extra income on the weekends when it comes to going to Native art shows. Native CDFIs make an impact with small loans and loans on a larger scale.

On standout stories told on the podcast so far:

ELYSE: They’re kind of all my favorites for different reasons, but I have to say my favorite might be our first episode, which was about an older Native couple in Montana that owns a cafe. It’s called the Big Sky Cafe, and it’s right off of the Blackfeet Reservation in a really small town. The cafe is one of two sit-down restaurants in the whole town, and it has become a gathering place for the community. I really loved interviewing the couple that owns the cafe and the Native CDFI staff members who helped them make it happen. They’re successful and able to make an income for themselves and support their family, but the cafe is also a place that is important to the community. People go there after football games and have dinner, the same people come and have coffee every morning. Those are the stories I love.

Difference Makers 2.0 is a new yearlong series that highlights how Native community development financial institutions (CDFIs) work alongside their small business clients to accelerate change and create economic opportunities in Native communities. Join the Native CDFI Network and Tribal Business News as they shine a spotlight on the people accelerating economic change in Indian Country. Read the stories here and be sure to tune into the Difference Makers 2.0 podcast.