- Details

- By Tribal Business News Staff

- Economic Development

GRAND RAPIDS, Mich. — Waséyabek Development Co., the non-gaming investment arm of the Nottawaseppi Huron Band of Potawatomi Indians, has acquired a majority stake in a West Michigan-based electronics manufacturer.

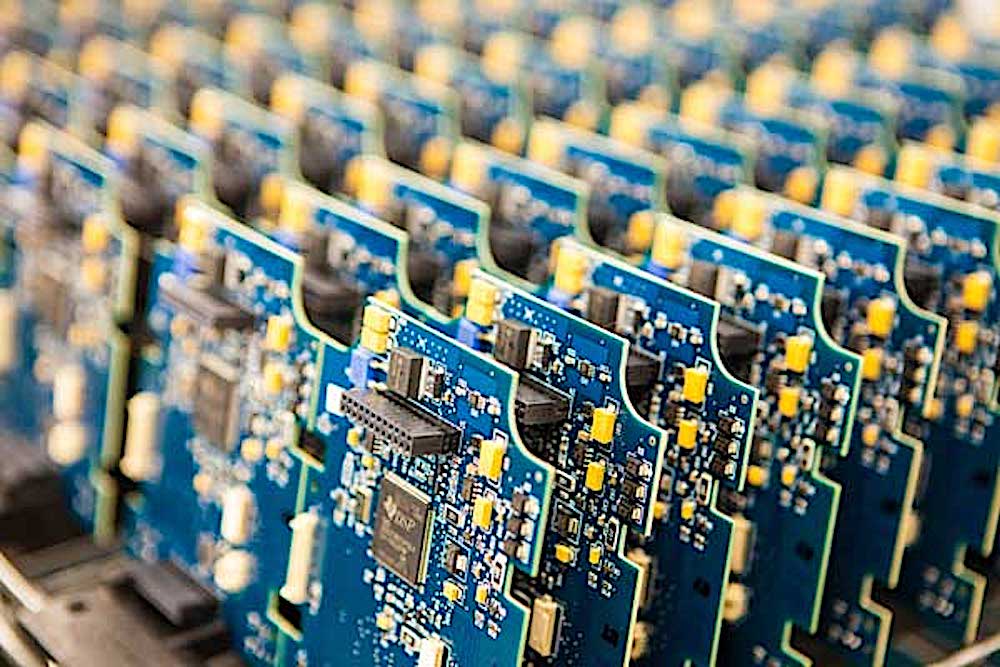

The deal for Safari Circuits, based in Otsego, Mich., about 35 miles south of Grand Rapids, adds capabilities in electronics manufacturing, engineering and supply chain management to Waséyabek’s existing investment portfolio.

Founded in 1985, Safari supplies customers in the medical, instrumentation, industrial, automotive and military sectors, and employs more than 150 people.

With the acquisition, Waséyabek expands its portfolio with additional manufacturing, medical and federal contracting capabilities.

Deidra Mitchell, president and CEO of Waséyabek Development Co. (Courtesy photo)Deidra Mitchell, president and CEO of Waséyabek, told regional business publication MiBiz that the holding company generates $70 million in overall annual revenue and serves as “an example for Indian Country on how to diversify their portfolios and their economies.”

Deidra Mitchell, president and CEO of Waséyabek Development Co. (Courtesy photo)Deidra Mitchell, president and CEO of Waséyabek, told regional business publication MiBiz that the holding company generates $70 million in overall annual revenue and serves as “an example for Indian Country on how to diversify their portfolios and their economies.”

Safari’s executive team will stay on and continue to lead the business. Founder Larry Cain cited Waséyabek’s “commitment to employees, the community, and our customers” as a key differentiator that led him to partner with the tribally owned firm.

“We believe the leadership at Waséyabek Development Company shares that commitment and will carry on that legacy,” Cain said in a statement.

Indeed, Mitchell said sellers often favor Waséyabek’s buy-and-hold strategy versus other buyers such as private equity firms.

“In many instances, we find sellers that have built their businesses from the ground up, with each business having its own culture and work family,” Mitchell told Tribal Business News for a report in November. “WDC’s buy-and-hold philosophy ensures that culture will remain intact and their work family will be taken care of. A big incentive for local sellers is knowing that we don’t plan to resell in five to seven years or relocate the company out of the area.”

The Safari deal follows the October acquisition of Holland, Mich.-based Zip Xpress and Green Transportation in which Waséyabek co-invested with Grand Rapids-based Gun Lake Investments, the non-gaming investment arm of the Match-E-Be-Nash-She-Wish Band of Pottawatomi, or Gun Lake Tribe.

As well, the two tribal firms co-invested in the $17.5 million January 2020 acquisition of 18-story McKay Tower in downtown Grand Rapids.

Waséyabek’s portfolio is split 40 percent in income-producing commercial businesses, 30 percent in federal businesses and 30 percent in commercial real estate. Its holdings include DWH LLC, a financial advisory, M&A and turnaround firm, as well as Muskegon, Mich.-based RSI Manufacturing and Nunica, Mich.-based Baker Engineering. The company also owns various commercial real estate in the greater Grand Rapids and metro Detroit areas.

The firm in November 2021 also invested $3 million in BAMF Health Inc., which is developing a new advanced cancer treatment clinic in Grand Rapids.

“Our goal when we established WDC was to have a positive and lasting impact on this region where our ancestors first settled,” Jamie Stuck, chair of the Nottawaseppi Huron Band of the Potawatomi Tribal Council, said in a statement. “We feel this investment (in Safari Circuits) will benefit our Tribal Members, the local economy, and all the people who call West Michigan home.”

Waséyabek was advised on the deal by the law firm of Dickinson Wright PLLC, accounting firm BDO USA LLP, and Huntington Bank. Grand Rapids-based investment banking firm BlueWater Partners LLC advised Safari Circuits, who worked with Kalamazoo, Mich.-based law firm Howell Parfet Schau PLC.

--

EDITOR’S NOTE: This story was updated from its original form to include deal advisers.