- Details

- By Brian Edwards

- Finance

Native Community Development Financial Institutions are calling on Congress to increase funding that would bolster community development and economic opportunities in Indian Country.

In a letter to Senator Patty Murray (D-WA), chair of the U.S. Senate Appropriations Committee, and Rep. Kay Granger (R-TX), chairwoman of the U.S. House Appropriations Committee, the Native CDFI Network (NCN) and 38 signatories urge Congress to increase funding for the CDFI Fund in the fiscal year 2024 appropriations process.

The appeal requests $366.48 million for the CDFI Fund, including $50 million for the Fund's Native American CDFI Assistance (NACA) program. The letter also calls for the continuation of the CDFI Bond Guarantee Program with $500 million in guarantee authority.

“With 64 certified Native CDFIs and two dozen more ‘emerging’ ones in Treasury’s certification pipeline, the Native CDFI industry is expanding rapidly to meet the growing needs of Indian Country,” the letter notes. “NACA program funding must keep pace with and support that growth.”

The unmet capital needs of Native CDFIs are significant, the letter writes, citing a 2022 survey conducted by NCN found that the projected three-year loan capital needs of Native CDFIs totaled $166 million. The letter also notes that the 16 Native CDFIs that completed the survey represent only one-quarter of the 64 certified Native CDFIs.

The number of Native CDFIs and the amounts being requested continue to grow. In fiscal 2022, funding requests by Native CDFIs for NACA’s financial assistance grants exceeded the amount awarded by nearly 49%; meanwhile, funding requests for NACA’s technical assistance grants exceeded the amount awarded by 15%.

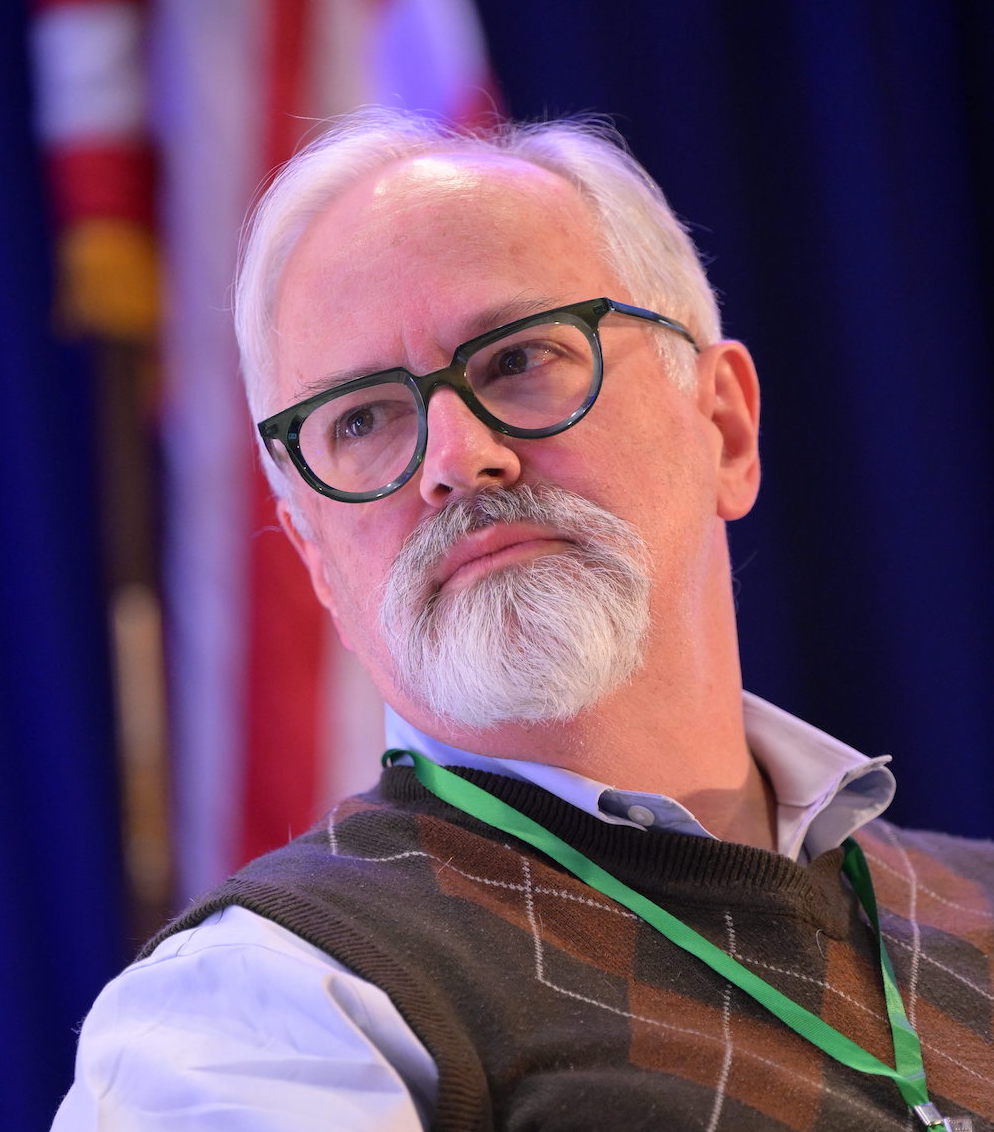

Seeing many of his peers in the industry being denied financial assistance funding was “disheartening” for Dave Tovey, executive director of Pendleton, Ore.-based Nixyáawii Community Financial Services. "Being the new guy, I certainly wondered how these small community operations made it through the stringent CDFI certification processes and continual reporting obligations while not having the capital resources needed to perform from that same agency."

This will be the first year of NACA funding eligibility for Nixyáawii, which was certified as a Native CDFI by the Treasury in Dec. 2021. Tovey is hoping to receive funding so it can expand its lending programs in small business and homeownership on the Umatilla Indian Reservation. His goal is to provide loan products and services that can help clients gain the financial acumen and build enough assets and collateral that they can secure next-level financing through conventional means.

“We don't think we can be the end-all for all financial needs, but do believe we can put the lion's share on a successful pathway," Tovey said.

In addition to NACA funding, Nixyáawii is also seeking funding from foundations and government agencies to raise an additional $5 million in new loan capital. Tovey said the nonprofit loan firm has had some recent success in securing funding from these sources, and he is confident it will be able to meet its goal of expanding its lending programs.

"In the ideal world and in keeping with our business plan, we aspire to raise another $5 million in new loan capital," Tovey said. "We have no illusion that any given source could fully meet that target and have had some recent success from foundations and government agencies with more requests pending."

The need for additional NACA funding is “long overdue,” according to Jonelle Yearout, executive director of Lapwai, Idaho-based Nimiipuu Fund, which serves the Nez Perce Reservation and surrounding communities.

“The demand is always beyond the allocation,” she said, adding “It is time for the Treasury to increase this allocation to NACA.”

Nimiipuu Fund has relied on NACA funding over the years to deploy loan capital and services, including financial literacy and technical assistance. Like many other Native CDFIs, she maximizes the NACA capital to generate additional money for lending to customers. “I know we can leverage any award we get from the Treasury (by a factor of eight).”

Nimiipuu plans to continue adding staff and loan products in response to its community’s needs, she said.

“In the work that we do, we are showing we’re needed and Nimiipuu Fund is a viable resource for our Tribal members,” she said, adding that the fund wants to create more success stories and promote sovereignty.

“I am proud to be serving our community and providing resources needed for our tribal members to live and prosper on the reservation,” she said. “If you think about federal policy historically, our wealth was taken from us. Tribes are wanting to take that back, and a financial institution is part of the solution.”