Real Estate

- Details

- By Tribal Business News Staff

- Real Estate

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

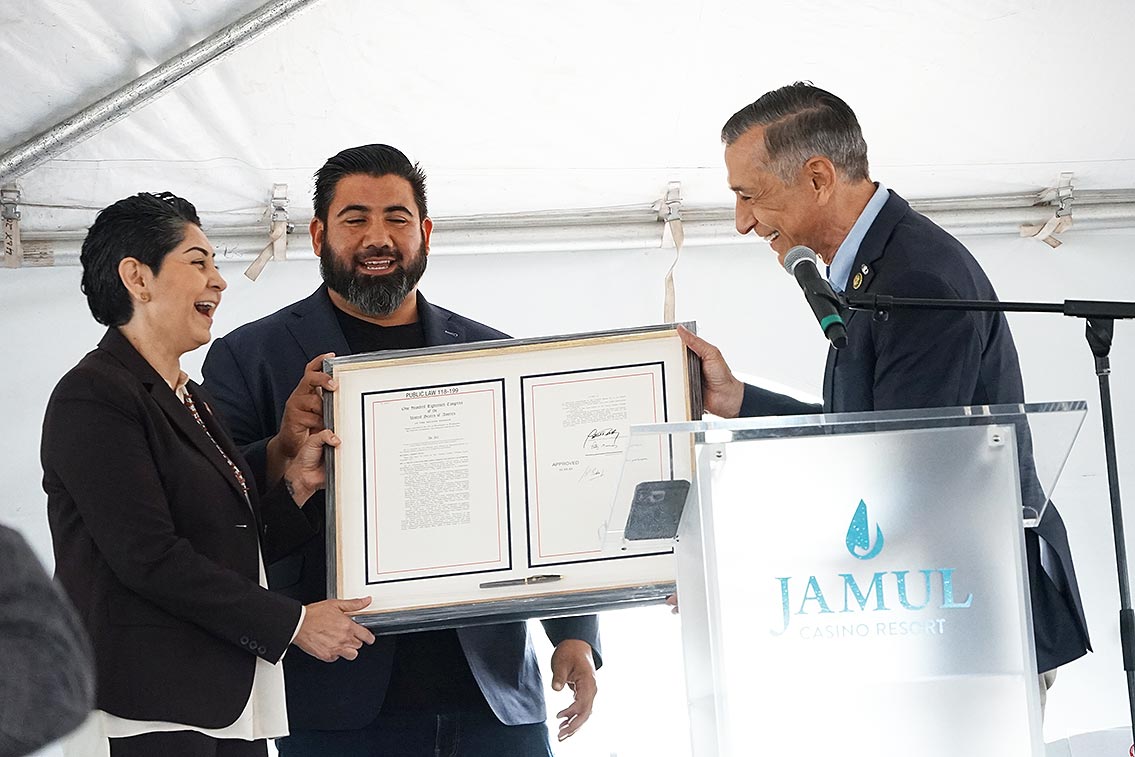

The Jamul Indian Village of California has announced plans to restore and develop four parcels of land transferred to the tribe late last year by Congressional action.

- Details

- By Chez Oxendine

- Real Estate

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Several homes on the Lac du Flambeau Band of Lake Superior Chippewa’s reservation are still standing because of a brief boost in federal Native housing funds — funding that faces elimination under President Trump’s recent budget proposal, which cuts $475 million from tribal housing programs.

- Details

- By Tribal Business News Staff

- Real Estate

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

The Wiyot Tribe has regained a portion of its ancestral lands as part of a 175-acre acquisition along northern California’s Elk River, where a nonprofit and state agency are working to restore the river’s estuary.

- Details

- By John Wiegand, Special to Tribal Business News

- Real Estate

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

As the former building commissioner for the City of Chicago and first Native American to hold that position, Matthew Beaudet (Montauk) has seen firsthand how effective building codes transform communities.

- Details

- By John Wiegand, Special to Tribal Business News

- Real Estate

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Floors collapse beneath residents’ feet. Black mold infestations that trigger respiratory illness. Homes so deteriorated they can’t keep out harsh South Dakota weather. On the Pine Ridge Indian Reservation, Ellen White Thunder sees beyond dilapidated buildings to the root cause: homes fundamentally compromised from day one.

- Details

- By Chez Oxendine

- Real Estate

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

The yak titʸu titʸu yak tiłhini Northern Chumash Tribe — known as the ytt Northern Chumash — has launched an $18 million campaign to acquire the historic Alexander Ranch, a former abalone farm along California's central coast.

- Details

- By Chez Oxendine

- Real Estate

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

The Stockbridge-Munsee Band of Mohican Indians has reclaimed a slice of home after a 200-year battle for their ancestral lands.

- Details

- By Tribal Business News Staff

- Real Estate

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

The city of Minneapolis plans to transfer 5 acres of federal land near the Upper St. Anthony Falls Lock-and-Dam to Dakota-led Owámniyomni Okhódayapi, a nonprofit organization aiming to utilize the land for a community gathering space.

- Details

- By Chez Oxendine

- Real Estate

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Rep. Elise Stefanik (R-N.Y.) has introduced legislation to ratify a land claim settlement agreement involving the Saint Regis Mohawk Tribe in New York. Once ratified, the agreement would allow the return of 3,500 acres to reservation status, with the potential to acquire up to 14,000 acres.

- Details

- By Chez Oxendine

- Real Estate

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

A stretch of land along one of America’s most endangered rivers has been acquired by the Rappahannock Tribe in Richmond County, Va.