- Details

- By Joe Boomgaard

- Economic Development

SANTA YNEZ, Calif. — The non-gaming economic development and investment arm of the Santa Ynez Band of Chumash Indians is further diversifying its portfolio of companies with the acquisition of a Florida-based specialty firearms components manufacturer.

Chumash Capital Investments LLC acquired Azimuth Technology LLC from New Orleans, La.-based LongueVue Capital Partners and Dallas-based Clavis Capital Partners, two private equity firms that invested in the company five years ago.

With the deal, the tribe’s wholly-owned Chumash Capital seeks to continue building out its investment portfolio of “sophisticated enterprises” for the benefit and economic security of future generations of tribal members.

“This acquisition allows the Santa Ynez Band of Chumash Indians to diversify its portfolio and adds a successful company to Chumash Capital Investments, which is focused on the tribe’s economic development and long-term stability,” John Elliott, CEO of the Santa Ynez Band of Chumash Indians, said in a statement to Native News Online.

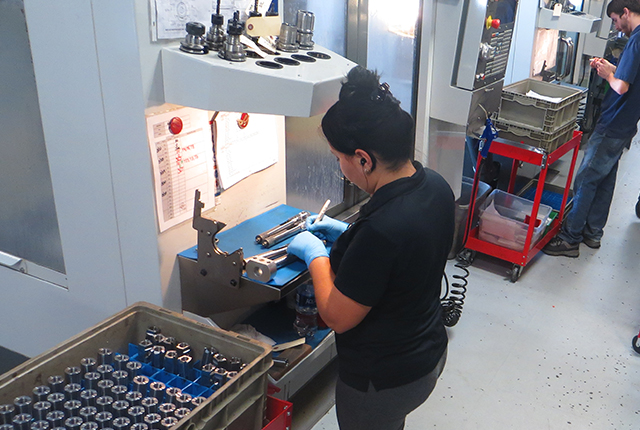

Naples, Fla.-based Azimuth Technology LLC, acquired by Chumash Capital Investments, is a manufacturer of specialty firearms components, including handgun slides and barrels.

Naples, Fla.-based Azimuth Technology LLC, acquired by Chumash Capital Investments, is a manufacturer of specialty firearms components, including handgun slides and barrels.

Terms of the deal, which closed Aug. 31, were not disclosed.

For Naples, Fla.-based Azimuth Technology, which was founded in 2011, the tribal ownership structure will position the company to further capitalize on federal government contracting opportunities. Drawing on a bench of experience in the medical device sector, the company manufactures tight-tolerance firearms components, including handgun slides and barrels, as well as bolt carrier groups for original equipment and aftermarket customers selling to the law enforcement and commercial markets.

Azimuth Technology also manufactures various products for the defense industry, including probes and protection systems for detecting improvised explosive devices, destructive systems for explosive ordnance disposal, and guidance and missile systems.

Azimuth CEO Len Zaiser IV, who along with other management is staying on with the company, said the Chumash Capital Investment deal “provides a major opportunity to target government and foreign military opportunities while continuing to serve our customers with leading quality, speed and precision.”

With the tribe’s backing, the company looks to “embark on our next phase of growth in the firearms and defense industry,” Zaiser said in a statement.

According to a midyear industry outlook from global audit, consulting, financial advisory, risk management, and tax services firm Deloitte, the defense industry remains strong despite temporary supply chain disruptions caused by the COVID-19 pandemic. Experts at Deloitte expect U.S. defense spending to flatten over the next year after a five-year growth spurt.

As well, the firm said the 2020 presidential election is “unlikely to have a major impact on defense budgets prior to 2022,” signalling continued growth opportunities in that sector for companies like Azimuth Technology.

“We believe Azimuth is primed for continued rapid growth, and we look forward to partnering with the Company’s outstanding management team to help Azimuth reach its full potential,” Elliott stated, adding that the investment offers “an attractive counterbalance” to Chumash Capital’s other investments in the hospitality and leisure industry.

Other economic development ventures for the Santa Ynez Band of Chumash Indians include Chumash Casino Resort; the boutique 122-room Hotel Corque, 71-room European-inspired Hadsten House Inn, and the Root 246 restaurant in Solvang; and Kitá Wines, a small vineyard and winery that produces 2,000 cases annually in the Santa Ynez Valley.

Chumash Capital Investments was advised on the deal by Texas-based merchant banking firm Horizon Business Advisors LLC and the Florida-based law firm of Holland & Knight LLP. Texas-based law firm Bell Nunnally & Martin LLP advised Chumash Capital Investments on transaction financing.